Editor’s note: NerdWallet’s Step by Step series gives small-business owners a behind-the-scenes look at the loan application processes for various online lenders. We show you what you can expect screen by screen as you submit your application.

Table of contents

Summary

Getting Started

Phase 1: Eligibility

— What if you don’t qualify?

Phase 2: Business details

Phase 3: Personal profile

Phase 4: Documents

Waiting for final approval

Apply at Funding Circle

When your small business already has some momentum and you want to take it to the next level, Funding Circle is a good financing option.

Funding Circle loans can be a smart move if you own a franchise or want to finance an expansion — and you have good credit. The company caters mainly to owners whose small-business finances and operations are in solid shape.

Funding Circle loan application: Summary

- Time to complete: 4 to 10 days

- Documents needed:

- Business tax returns (previous two years)

- Personal tax return (previous year)

- Statements from business bank account (previous six months)

You may qualify for a Funding Circle loan if your business has been around for at least two years and has revenues of at least $150,000 per year. However, the typical Funding Circle borrower has been in business for 10 years and has annual revenue of $2 million. You must have a personal credit score of at least 620, but the average credit score of funded borrowers is around 700, according to the lender.

For more details, read our Funding Circle review.

| Funding Circle term loan at a glance | |

|---|---|

| Cost of funding | 7% - 26% APR |

| Loan amount | $25,000 - $500,000 |

| Loan terms | 12, 24, 36, 48 and 60 months |

| Qualifications | Personal credit score at least 620; at least 2 years in business; minimum $150,000 in annual revenue; profitable at least 1 of last 2 years; no bankruptcy in last 7 years; personal guarantee required |

|

|

|

Getting started

You’ll find two options on Funding Circle’s homepage. One invites you to “Get a business loan,” the other to “Invest your money.”

Don’t be thrown off by the second option. Funding Circle is a peer-to-peer small-business lender, which means the site also serves investors.

Clicking on the “Get a business loan” section will take you to a page with the headline “Determine your eligibility for a Funding Circle loan.”

You’ll also see this identified as “Eligibility” on a timeline, followed by the next steps in the process:

Phase 1: Eligibility

Time to complete: About 1 minute.

Documents needed? No.

In this phase, you’ll answer questions on time in business and revenue.

Note that you cannot have filed for bankruptcy within the last seven years. (If you answer that you have filed for bankruptcy, a question pops up: “Was that bankruptcy in the last seven years?”)

What if you don’t qualify?

If you’re not qualified based your answers to the eligibility questions, you’ll be taken to a page that says, “Unfortunately, you are not a good match for us at this time.”

Here’s an important tip: If you make an error in the eligibility questionnaire — say, you mistakenly clicked “no” for the second question — you’ll receive the above message and be automatically shut out of the platform. You’ll have to contact Funding Circle to reset your account. So type carefully.

If you qualify, you’ll move on to the second phase.

Phase 2: Business details

Time to complete: About 4 minutes

Documents needed? No.

You can choose more than one business need for the money. You can also click on “Other” and explain any unique reasons for needing the loan.

You’ll be asked to fill out other basic information, including the location of your small business and the name of your business partner, if you have one.

Phase 3: Personal profile

Time to complete: About 3 minutes

Documents needed? No.

In the next section, Funding Circle will ask for your personal information. You’ll be asked to provide your:

- Social Security number

- Phone number

- Address (Funding Circle will want to know if it’s a rental)

You’ll also have to provide information about your personal finances, including details about your cash savings, the amount you have in retirement accounts, and the value of the stocks, bonds and other securities you own.

You’ll then answer two questions related to your legal history:

- Have you ever been convicted of a felony?

- Are there any legal actions against you?

Will you be automatically disqualified if you answer “yes” to either question? The short answer is no.

“An applicant won’t be automatically disqualified, but having these questions on the application allows us to address this head-on during our underwriting process,” Liz Pollock, Funding Circle’s head of communications, tells NerdWallet.

Remember that Funding Circle will run a background check to verify the information you provide, she says.

Once you’ve completed your online application, Funding Circle will also pull your personal credit score. This is a hard inquiry that will temporarily lower your credit score.

Phase 4: Documents

Time to complete: 10 minutes (if you have everything ready)

Documents needed? Yes.

If you’ve prequalified based on your personal information, it’s time to get your documents ready.

You’ll need to upload the following:

- Your business tax returns from the previous two years

- Your personal tax return from the previous year

- Your operating account’s bank statements from the previous six months

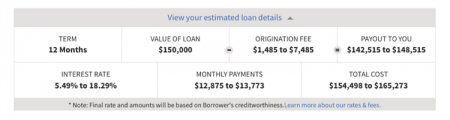

By this stage, you should see a link near the top of the page leading to a tentative loan package that you may qualify for based on the information you’ve provided. It includes a loan amount, a term, a range of possible origination fees and a range of monthly payments:

You’ll also see a range of interest rates. Be aware that these do not reflect your APR, which is the true cost of your loan. Currently, Funding Circle offers loans with APRs of 7% to 26%. The interest rate listed on “View your estimated loan details” could be lower than your final APR.

This will eventually be explained to you by a Funding Circle personal account manager, who will “walk each applicant through their APR over the phone to ensure they understand the true cost of their loan and can accurately compare this with other loan offers,” Pollock says.

Toward the end of the page, you’ll be asked: “Does your business have outstanding business debt?”

If you answer “yes,” you’ll have to provide information on that debt, including your lender, your balance, your minimum payment and the reason for the loan. Funding Circle will also ask if you’d like to refinance that debt.

What if you don’t have your documents in digital form? Not a problem. You can send the documents via regular mail, Pollock says.

Waiting for final approval

Time to receive: Within 3 days

Funding following approval: Within 2 days

After you’ve submitted your application, a Funding Circle account manager will contact you within two hours to schedule a call, Pollock says.

The account manager will use this call “to get to know your business better” and to answer any questions, she says.

You’ll get a thumbs up or down on your loan application within three days. If you’re approved, your account manager will reach out again to discuss your loan, including the final terms, the APR and the fee structure.

If you’ve been shopping around for loans, Pollock notes that information provided by the account manager will allow you to accurately compare your offers.

“If you have received an offer from another lender who did not provide an APR, your account manager can also help you calculate it or direct you to resources that can help you do the calculations on your own,” she adds. “That way you can make an apples-to-apples comparison on pricing.”

NerdWallet’s interactive small-business loan tool also lets you make loan comparisons.

Following the phone conversation with the Funding Circle account manager, you’ll receive an email confirming the offer, with all closing documents attached.

The process may take a few days longer for applicants who do not have all required documents ready, but it typically takes no more than 10 days for an approved borrower to receive a loan, Pollock says.

Nerd note: The number of phone calls and email exchanges with an account manager generally depends on you. If you like, you can contact an account manager and get info on products or the process before submitting your application, Pollock says.

If you accept the loan offer, you’ll receive the funds within two business days.

“We’re committed to keeping the entire process to less than 10 days,” Pollock says.

To apply

If Funding Circle sounds like the right fit, apply on the lender’s secure site:

Find and compare small-business loans

NerdWallet has created a comparison tool of the best small-business loans to meet your needs and goals. We gauged lender trustworthiness and user experience, among other factors, and arranged them by categories that include your revenue and how long you’ve been in business.

Benjamin Pimentel is a staff writer at NerdWallet, a personal finance website. Email: bpimentel@nerdwallet.com. Twitter: @benpimentel

To get more information about funding options and compare them for your small business, visit NerdWallet’s small-business loans page. For free, personalized answers to questions about financing your business, visit the Small Business section of NerdWallet’s Ask an Advisor page.

No comments:

Post a Comment