Earnest at a glance: Earnest makes personal loans to responsible borrowers with thin credit files. Earnest is a good fit for those who:

Earnest at a glance: Earnest makes personal loans to responsible borrowers with thin credit files. Earnest is a good fit for those who:

- Are new to credit.

- Have an excellent credit score (generally above 720).

- Have a high income.

- Save money on a regular basis and maintain a retirement savings account.

- Do not carry a lot of debt; an Earnest personal loan is not typically for debt-consolidation borrowers.

- Have enough income to cover expenses and a low debt-to-income ratio.

- Have no delinquencies or defaults.

Detailed Earnest personal loan review

To review Earnest, NerdWallet collected more than 30 data points from the lender, interviewed company executives, completed the online loan application process with sample data, and compared the lender with others that seek the same customer or offer a similar product.

If you make a steady income, pay your bills on time and save for retirement, you might expect to borrow money at a low interest rate. But a limited credit history can outweigh those factors when you go shopping for an unsecured personal loan — even if you have excellent credit scores.

Earnest wants to be the Amazon of lending, understanding its customers to build an ongoing relationship, CEO Louis Beryl says.

The San Francisco-based lender collects and analyzes thousands of data points about each prospective borrower, which is how Earnest says it’s able to assess risk and offer rates as low as 5.25%.

SoFi, Upstart and Pave serve similar borrowers: those who are new to credit but have high earning potential and are responsible with their finances. SoFi pauses loan payments if a borrower becomes unemployed and provides career coaching. Upstart gives loans even to those who don’t have a credit score yet, while Pave rewards borrowers who take loans to move forward in their careers with lower rates.

Earnest offers flexibility, letting borrowers change their payment date and amount at any point during the loan, and also doesn’t charge any fees.

How to apply

In a six-step online application, borrowers provide Earnest basic data about their education, loan purpose and employment histories. They can ask the site to pull information from their LinkedIn profiles to speed up the process:

Applicants have to give Earnest permission to scan their bank accounts. The lender’s algorithm analyzes every transaction, payment, deposit and withdrawal, then uses that to paint a picture of each applicant’s financial habits. Earnest says it doesn’t store any of the information. The company conducts a hard credit check with credit bureau Experian before finalizing the loan:

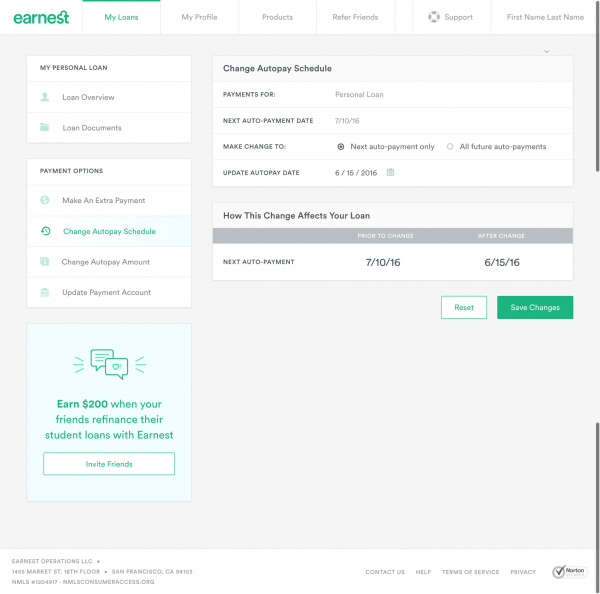

Borrowers can change their loan payment amount or date at any time and see how it affects the remaining payments. The changes can be one-time or recurring:

Minimum requirements for an Earnest loan

- Minimum credit score: None, but generally 720+.

- Minimum gross income: None, but generally high.

- Minimum credit history: None.

- Maximum debt-to-income ratio: None.

Earnest’s lending terms

- APR: 5.25% to 12%.

- Minimum loan amount: $2,000.

- Maximum loan amount: $50,000.

- Minimum loan duration: 1 year.

- Maximum loan duration: 3 years.

- Time to receive funds: Up to a week.

Earnest’s fees and penalties

- Origination fee: None.

- Prepayment fee: None.

- Late fee: None.

- Personal-check processing fee: None.

Before you take a personal loan

If you have a good credit score and are borrowing to consolidate debt, you have cheaper options besides an unsecured personal loan. You might be able to find a 0% credit card promotional offer. Someone who owns a home might be able to get a home equity line of credit. And you’ll still want to compare other lenders. (See “Personal Loans for Debt Consolidation.”)

Check your credit and know your financial strengths. Your chances of being approved for a loan and the interest rate you get largely depend on your credit score, but the length of your credit history, your income and other debts also carry weight. A high credit score may be offset by high debt levels, for example, or a low score could be bolstered by a high income.

Learn how personal loans work. You’ll need to give lenders certain personal information to verify your identity and your income, as well as check your credit.

Calculate payment scenarios. Run the numbers on different amounts at different rates; consider how the payments might affect your monthly budget.

Have a plan for getting out of debt. Personal loans are one way to tackle debt, but in the long run you’ll need a budget that lets you live off your earnings and also put something away for emergencies and opportunities.

Alternatives to Earnest

|

Lender

|

Detail

|

Get Started

|

|---|---|---|

|

Works with poor credit

|

||

|

Works with good credit

|

||

|

Works with thin (but excellent) credit

|

More from NerdWallet:

Compare Loans for Good, Fair and Bad Credit

The Best Loans to Consolidate Credit Card Debt

The Best Personal Loans for Good Credit

Amrita Jayakumar is a staff writer at NerdWallet, a personal finance website. Email: ajayakumar@nerdwallet.com. Twitter: @ajbombay.

No comments:

Post a Comment