LightStream stands out by giving borrowers with excellent credit low interest rates on unsecured personal loans. The lender’s interest rates are low enough to compete with traditional loans that require collateral.

The lender’s model is based on one simple factor: What you buy determines the interest rate you pay. If you meet its high credit standards, LightStream has interest rates tailored for everything from buying a horse to paying for fertility treatments. (The company doesn’t offer loans for college tuition or businesses, however.)

LightStream recognizes that a loan to pay off existing debt is inherently riskier than, say, one for buying a new car, says Todd Nelson, the company’s director of business development.

No other online lender offers interest rates tailored to a specific purpose. Pave gives borrowers who take loans for self-improvement a lower rate. Earnest and SoFi allow high loan amounts and offer low rates to those with excellent credit, but do not differentiate based on loan purpose.

LightStream is an arm of SunTrust Bank, and it’s also one of the country’s oldest online lenders. Founded as FirstAgain in 2005, the company was acquired by SunTrust in 2012. Borrowers do not need to be SunTrust customers to receive loans.

LightStream at a glance

To review LightStream, NerdWallet collected more than 30 data points from the lender, interviewed company executives, completed the online loan application process with sample data, and compared the lender with others that seek the same type of customer or offer a similar product.

LightStream is a good fit for those who have:

- An excellent credit score (ideally higher than 720).

- Five or more years of credit history.

- Varied forms of credit, such as multiple credit cards, a mortgage and auto loans.

- A retirement savings account or a proven ability to save.

- Few or no payment delinquencies.

- A low debt-to-income ratio and low utilization of credit on credit cards.

- A co-signer with excellent credit. LightStream takes joint applications and allows one party to have a lower credit score.

- A desire to avoid the paperwork or hassle that accompanies a secured loan from a bank.

As of June 2016, a well-qualified borrower getting LightStream’s best rates on an unsecured, $25,000 three-year loan would pay:

- 2.19% APR on a new car loan.

- 4.29% for a home improvement/solar installation/pool loan.

- 5.29% for a credit card or debt consolidation loan.

How to apply

Before applying, select your loan purpose on LightStream’s website. You can view the entire interest rate range for that purpose:

Fill out a detailed application that explains your finances. You can select an individual or joint application. You may need to upload documents to verify your identity and income, and you’ll have to create an account:

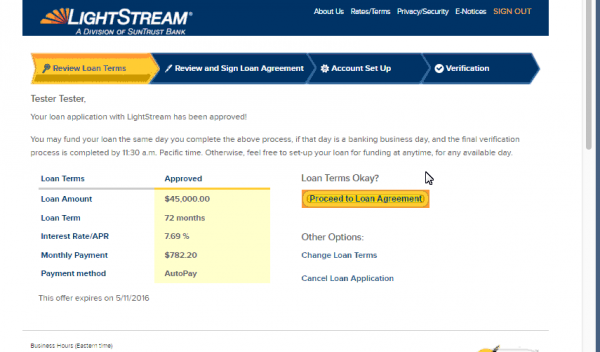

LightStream tells you whether you’re approved — usually within minutes — and the terms of the loan offer. The lender conducts a hard pull on your credit report from the Equifax or Experian credit-reporting agencies, and a loan officer looks at the application:

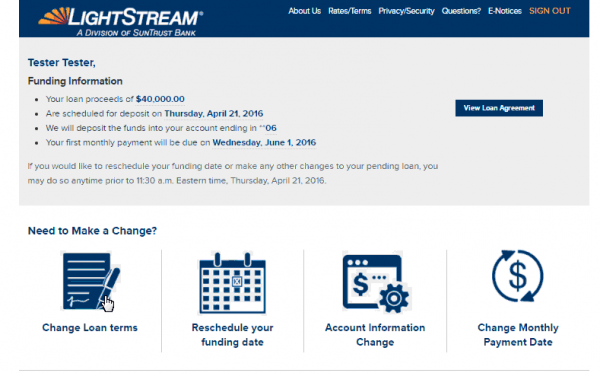

Once you approve the loan terms, you specify where the funds should go. You can also select to receive the funds on a specific date within 30 days of approval and choose a monthly payment date. LightStream reports timely payments to all three credit bureaus:

Minimum requirements for a LightStream loan

- Minimum credit score: 680, but borrowers’ scores are generally much higher.

- Minimum gross income: None, but generally high.

- Minimum credit history: No requirement, but borrowers typically have more than five years of credit history.

- Maximum debt-to-income ratio: None, but generally low.

LightStream’s lending terms

- APR range for unsecured loans: 4.99% to 14.49% with autopay (minimum/maximum rate varies based on loan purpose).

- Minimum loan amount: $5,000.

- Maximum loan amount: $100,000.

- Minimum loan duration: 2 years.

- Maximum loan duration: 7 years.

- Time to receive funds: Same day, with option of up to 30 days from approval.

LightStream’s fees and penalties

- Origination fee: None.

- Prepayment fee: None.

- Late fees: None.

- Personal-check processing fees: 0.5% added to APR for non-autopay payments.

Before you take a personal loan

Consider a 0% APR credit card. There may be other answers for your need besides an unsecured personal loan. As someone with great credit, you might be able to find a 0% credit card promotional offer. A homeowner might be able to get a home equity line of credit. You’ll still want to compare other lenders, too. (See “Compare Best Rates and Lenders.”)

Check your credit and know your financial strengths. Loan approval and interest rates depend on more than just your credit score. Lenders look at the length of your credit history, your income and other debts you carry. High debt might negate a great credit score, for example, or a low score might be bolstered by a high income.

Learn how personal loans work. You’ll need to give lenders certain personal information to verify your identity and check your credit, and you’ll need to document your income.

Calculate payment scenarios. Consider how the payments might affect your monthly budget. Run the numbers on different loan amounts and interest rates.

Amrita Jayakumar is a staff writer at NerdWallet, a personal finance website. Email: ajayakumar@nerdwallet.com. Twitter: @ajbombay.

This article updated June 13, 2016. It originally published Feb. 18, 2016.

No comments:

Post a Comment